CONCLUSION

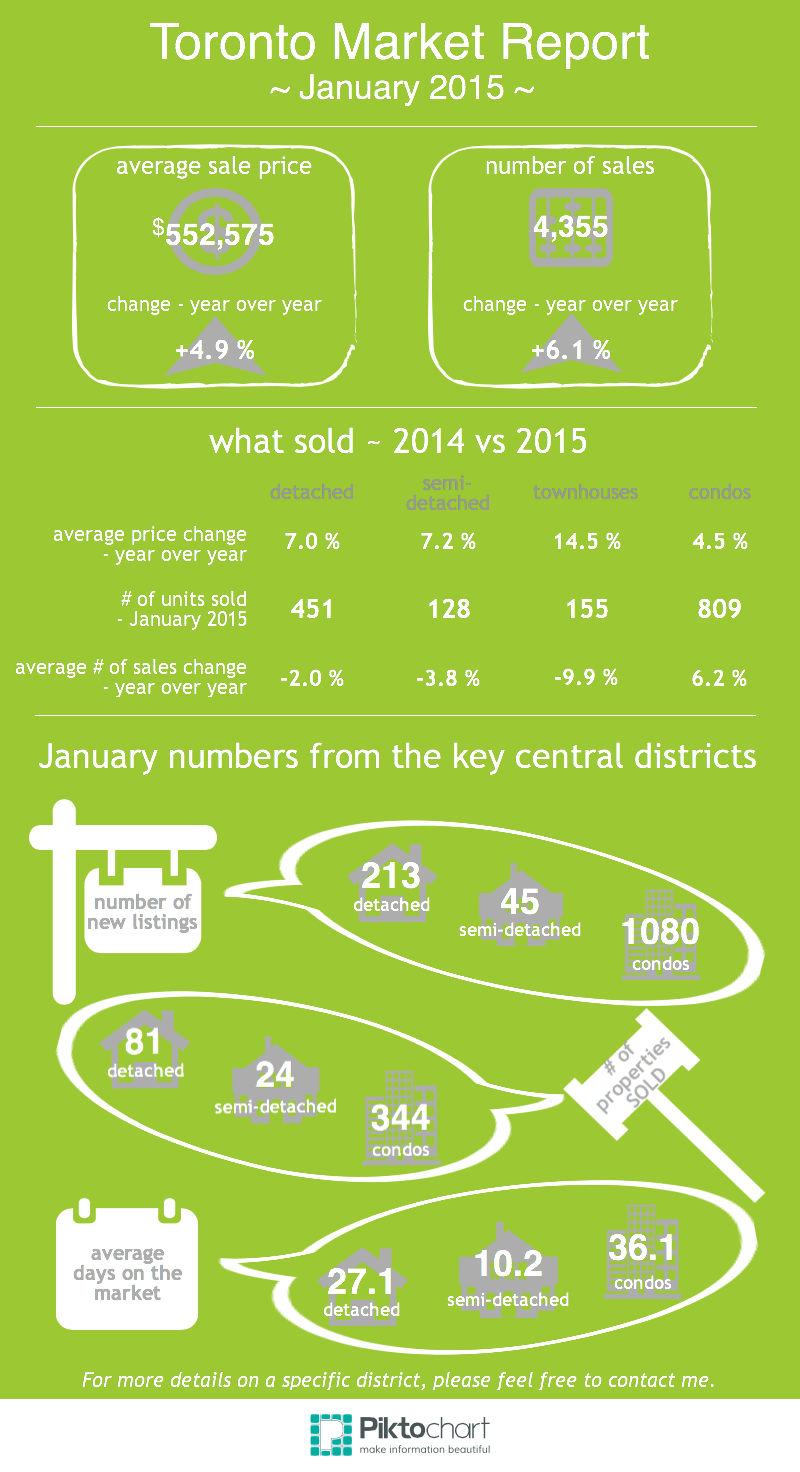

In January the average sale price for detached houses in Toronto was 7 percent higher than last year, notwithstanding that the number of sales were off by 2 percent, a clear indication of an inventory shortage. The same was true for semi-detached properties where the average price was 7.2 percent greater than last January’s average sale price, despite sales being lower by 3.8 percent.

Average sale prices for detached and semi-detached properties were substantially higher in Toronto’s central districts. The average sale price for central district detached homes came in at $1,422,382. For semi-detached properties it came in at approximately $800,000. Here’s an interesting stat – if you’re following the high end market…anything with a price tag of 1MM or greater, you’ll notice that sales have increased fairly dramatically in the last three years. In January, 313 properties changed hands. In 2014 that number was 236, and in 2013 only 195. Since 2013 the number of high-end property sales has increased by more than 60 percent. Next month I’ll run those same numbers for 2MM and up.

Not surprising that due to inventory shortages and the price points of detached and semi-detached properties more buyers are looking to condominium apartments as alternative housing options. In January condominium apartment sales posted an increase of 6.2 percent compared to sales in 2014.

A concern expressed throughout 2014 was the impact that these constantly increasing prices will have on affordability. Monthly increases have consistently exceeded wage increases by 200 to 300 percent. It has been the historically low interest rates that have bridged the affordability gap.

In January mortgage interest rates became even lower, reaching levels never seen before. The Bank of Canada cut the overnight bank rate by 0.25 basis points, reducing it to 0.75 percent. Canada’s big banks reduced the five year mortgage interest rates to as low as 2.69 percent. Borderline buyers are now capable of qualifying for mortgages. No doubt demand will be even further inflamed, particularly if further rate cuts follow. That will all depend on how the oil prices track. If they continue to decline, the Bank of Canada may cut again; great for house hunters, not so good for our overall economy.