So, what’s new? The biggest piece of news is the federal government’s new mortgage rules that took effect February 15th. These changes are intended to cool the overheated market, and will impact homebuyers in Toronto and Vancouver the most. In a nutshell, the minimum down payment for new insured mortgages was increased from 5 to 10 per cent on the portion of a property priced over $500,000. This means that the minimum downpayment will rise to $45,000 from $35,000. Any home under $500,000 still requires a down payment of 5 percent, while homes over $1 million still require a 20 percent down payment.

Home ownership is an important goal for many Canadians. However, the rising cost of real estate and endless financial demands of home ownership are making this goal more expensive and less probable for many of us.

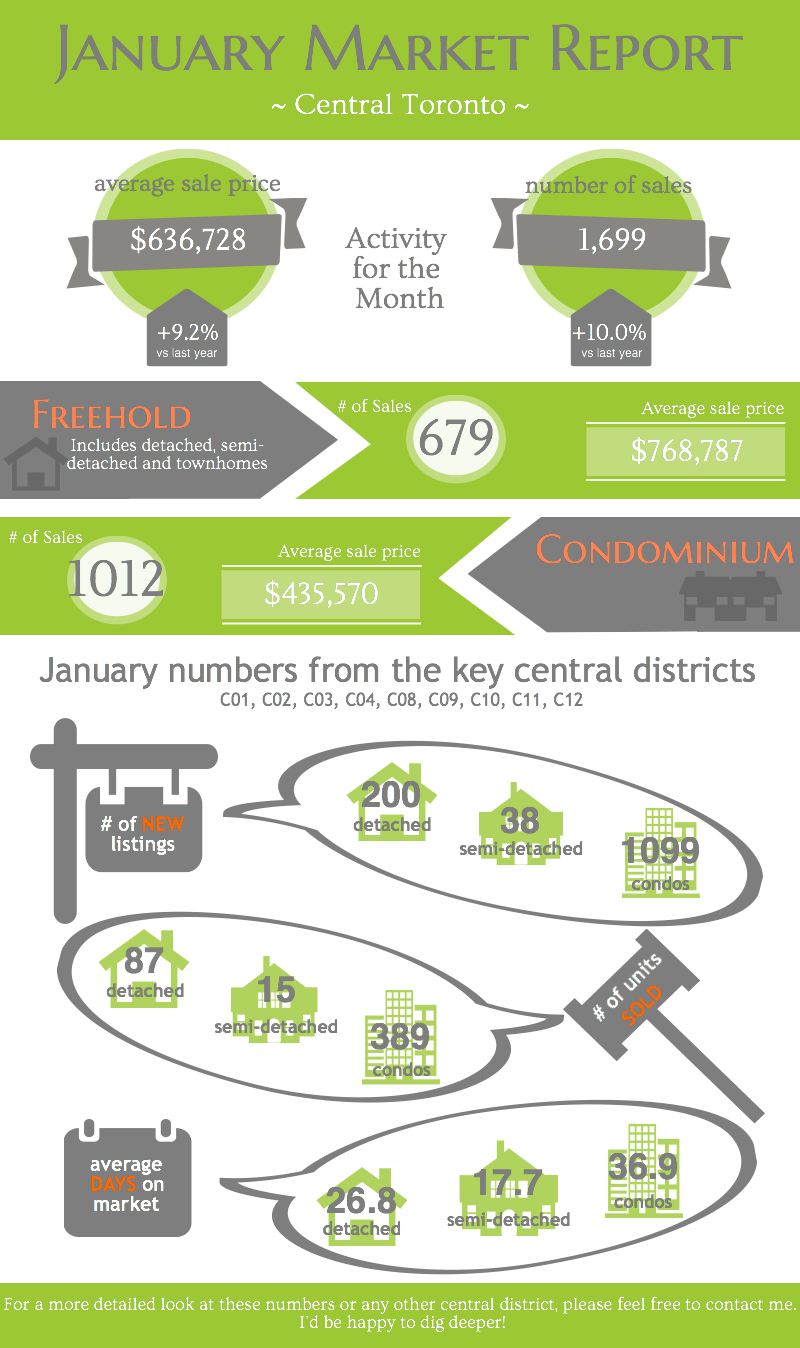

We expect this market to remain strong for the remainder of 2016. So, if you’re planning to be a seller this year, you’re in luck. And… if you’re going to be a buyer, keep the faith and don’t give up. Your persistence will pay off with a house you can call home.