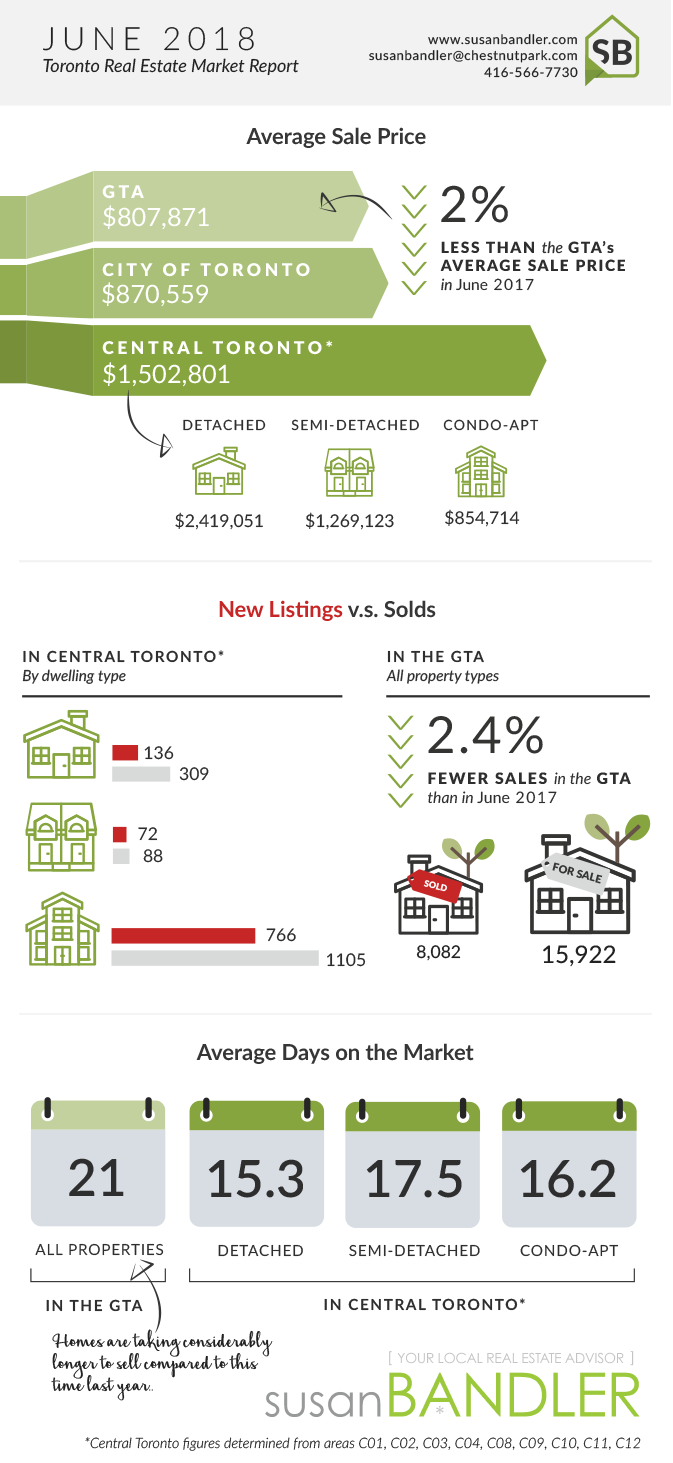

For the first time since the mortgage stress test was implemented, the market saw a positive variance between the number of sales and average sale prices. The GTA saw a 2% increase in the average sale price from June 2017, while Toronto-proper enjoyed a 4% gain – no thanks to semi-detached homes which took a bit of a plunge on account of surplus supply.

This optimism has lead many people to wonder if the market has finally adjusted to the year-old legislation. It’s encouraging to think this way, but in the words of Gregory Klump, Chief Economist at Canadian Real Estate Association (CREA): “One car doesn’t make a parade.” We’ll have to wait a few more months to see if a trend takes shape.

At first glance of the incomplete July numbers, it looks like we’ll see a second straight month out-perform its 2017 counterpart. That said, July – like all Julys – is a slower month; cottage-country calls buyers up north and prospective sellers are waiting for the back-to-school market.

I expect prices to continue their upward trend with small steps until the fall market, where we hope to see heightened activity.

Together we’ll determine the best strategy for a successful move in this market. If you have questions, I’m here to help. Reach out to me today: 416.566.7730 or susanbandler@chestnutpark.com.